Borrowing from his personal experience, Sumeet has penned this article for the benefit of youth/students. The Student Debt Crisis is USD 1.80 Trillion trapped in the US and expected to fast catch up in India. So, he is optimistic that a paradigm shift in the student loan product and small change in behavior by students can make the next generation create wealth equivalent to the student loan amount.

Education has become an expensive affair especially when you subscribe to a professional degree like engineering or MBA. Most of the students go for a loan and the burden is heavy on their shoulders. It takes almost a decade to return the loan sometimes. But there is a way to create some wealth from education loans too. Let me explain this!

I took an MBA education loan of INR 15 Lacs @ interest rate of 10.50% in 2011. The moratorium period was a study period plus 12 months and the term of loan was 7 years. The best thing about the unsecured education loan I liked was that the Bank has insured me for the duration of loan by paying approx INR 14,000/- to its partner insurance company. In other words, if something happened to me during the duration of the loan, bank money was secured through insurance. My monthly EMI was INR 25,291/-.

Today when I look back, I think it would have been better if a wealth product was also clubbed with education loan & insurance. Let me explain in more detail. Bank could have lent me a top up of approx 25% (on loan of INR 15 lacs) towards wealth creation and invested a top up amount of INR 3,75,000/- in equity/ETF/mutual fund on my behalf. With a top up loan towards wealth, the total loan would be INR 18,75,000/- and my EMI will increase to INR 31,613/-. The bank could also give me an option to increase my tenure of loan to 10 years (vs 7 years) to lessen my monthly EMI i.e. to INR 25,300/-. This will keep my EMI the same. The summary is as:-

| Loan Amount (INR in lacs) | Tenure (in years) | Interest Rate (in %) | EMI (in INR) | |

| Case 1 | 15.00 | 7 | 10.50 | 25,291 |

| Case 2 | 18.75 | 7 | 10.50 | 31,613 |

| Case 3 | 18.75 | 10 | 10.50 | 25,300 |

Source: https://www.credenc.com/central-bank-of-india-education-loan

Mutual funds in India give a compounded annual growth rate of return (CAGR) of 12% to 18%. Let me take the median CAGR of 15%. So, the top up loan amount invested in the mutual fund would have a future value of INR = 23,07,295/-. Isn’t it interesting? I’ll get INR 23.07 lacs at the end of the tenure of my loan. Of course, I had to pay a little more EMI in 8th, 9th and 10thyear. INR 9,10,800/- to be exact.

Most importantly, I have an additional incentive to pay my loan as I am going to receive a sum of INR 23.07 lacs at the end of tenure of my loan. A small shift in the loan product could have brought a huge change in my wealth creation. I think this can be made applicable on all existing loans and fresh loans for future generations. It’s a win-win for everyone.

Having said that, let me share a second approach where anyone having an education loan can create wealth without bank intervention. Let’s take an example of an education loan of INR 15 lacs @ 10.50% for 7 years where monthly EMI is INR 25,291/-. Education loan is available for a maximum period of 15 years. My suggestion is to extend it to 10 years, where monthly EMI would be INR 20,240/- and invest saved monthly EMI amount of INR 5,051/- (INR 25,291/- minus INR 20,240/-) in Mutual Fund SIP or any equity related product. If the equity instrument gives a return of 15% p.a., then you’ll create a wealth of INR 13.90 Lacs.

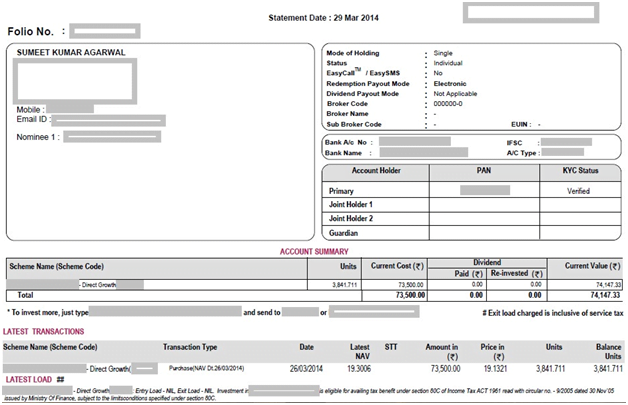

Initial question which comes to mind is that all is good theoretically, but is 15% return practical? Let me share with you from my 1st personal experience of investing in a mutual fund. My 1stjob after MBA was in Mumbai in 2013 and I made my 1st investment in Mutual Fund ELSS to save income tax under 80C. Here is snapshot of allotment of Mutual Fund units:-

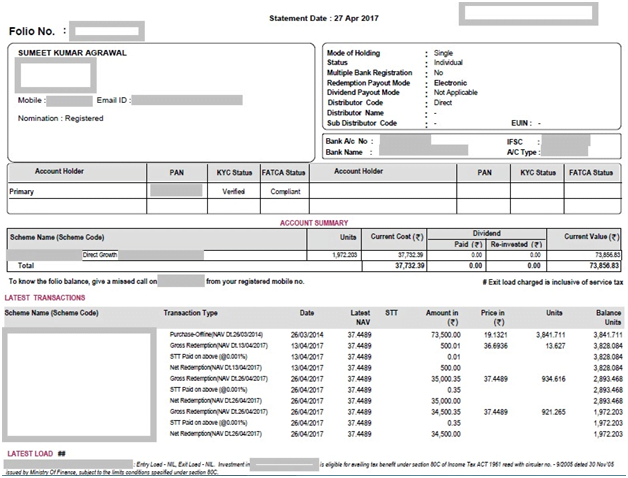

Guess what, my investment doubled in 3 years and I withdrew my invested amount and left the profit amount to grow more. That’s CAGR of 26%. Here is snapshot of my redemption:-

So, what’s the catch? How can I generate good returns from investment in equity based instruments? Here is my answer. Select your advisor wisely and make investment as per his/her advice.

Please take note that I have taken an interest rate of 10.50% as that was the rate at my time. Now interest on education loans is between 7.50% to 9.00%. So, there is a lot more on the table to be made. I hope you make the most out of it. Please do share your suggestions, feedback and fresh ideas.